Current Issues in the Scope of Tax Resident Status

Background

There are more than 3,500 bilateral tax treaties which are meant to avoid the disruptive effects of double taxation on cross-border trade[1]. Most of these treaties use language largely in line with the OECD Model Tax Convention, with about 80% of the wording of the tax treaties being identical[2]. While this convergence is good in that it has created relatively stable and commonly used international taxation standards, the current OECD Model still leaves extensive room for nations and especially persons to interpret and adopt the standards according to their circumstances. [3] In particular, the issue of the scope of tax residency (which determines the tax jurisdiction) allows corporations to not only avoid double taxation but also largely avoid paying taxes at all via treaty shopping. Despite the failure of currently accepted remedies such as mutual agreement and specific clauses, this issue may be rectified through multilateral treaties.

Issue on Tax Resident Status

According to Article 4 of the OECD Model, the primary criterion for determining tax resident status is whether the entity has a full tax liability, which is usually determined based on domicile, residence, place of management or any other criteria of a similar nature. Like nationality, which is primarily based on the principles of descent and place of birth (original acquisition), the determination of tax resident status is based on the subject’s connection to the state. In the practice of international taxation, each sovereign state has its own criteria for determining the status of a tax resident, which often raises conflicts in international tax practice regarding the determination of tax resident status (i.e., two or more states consider the subject to be a tax resident at the same time) and the exercise of tax jurisdiction.

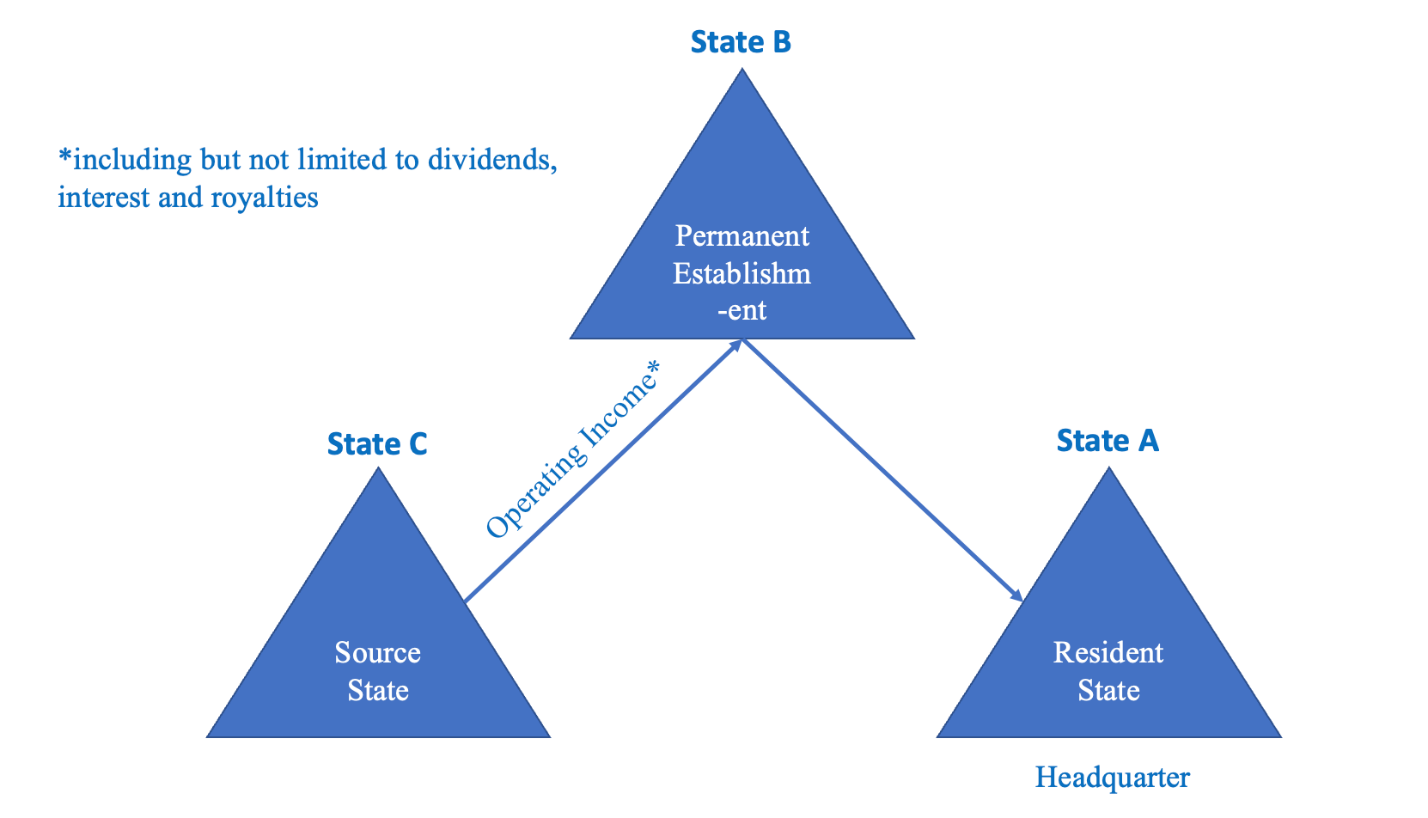

A common situation is the Triangular Case[4], which, in simple terms, means that the same income involves the tax jurisdiction of three or more countries[5]. Take the Permanent Establishment as an example. According to Article 5(1) and its notes in the OECD Model, Permanent Establishment means a fixed place of business where an enterprise conducts all or at least part of its business[6]. Double or even multiple taxation may happen without communication and coordination among those nations, which calls for a clear and widely accepted formulation.

Existing Practice and Shortcomings

As mentioned above, the unclear scope of tax resident status as well as the inconformity among bilateral treaties allow corporations to take advantage of treaty shopping to achieve the substantively unfair result of tax avoidance. The international community has been long working on solving this issue while trying to maintain market activity. However, the existing solutions – mutual agreement and the adoption of Limitation on Benefits Clause and Principal Purpose Test Clause – cannot work as efficiently as expected given their natural disadvantages.

After the abandonment of the Gabi Rule[7], which had long been used as the method to confirm the taxation jurisdiction of entities with dual residence, the method of mutual agreement is gradually becoming the mainstream approach following the establishment of Article 4 of the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (BEPS MLI) in 2017. Since then, it has become an effective measure to identify tax residents and resolve conflicts in the exercise of tax jurisdiction, as well as to prevent tax residents from abusing their tax resident status for the purpose of tax avoidance, based on a case-by-case analysis by the competent authorities.

Nonetheless, inconsistent measures remain in practice to resolve conflicts of tax jurisdiction arising from dual resident status. Taking China as an example, the determination of a non-individual resident in China’s bilateral tax treaties is generally based on the “location of the head office” standard (as seen in the bilateral tax treaties concluded between China and Australia, India and Laos), or the “location of the actual management office” standard (as seen in the treaties concluded between China and Russia, the Netherlands, Malaysia and the United Kingdom), or separately by negotiation between the competent authorities of the contracting parties (e.g., treaties between China and the Philippines, Chile, Cambodia, and New Zealand), or by negotiation between the competent authorities of both parties as the final method when the actual place of management cannot be determined (e.g., the Chinese treaties with Singapore and Ireland)[8]. From the above, we can tell that the current formulation of the criteria for determining non-individual resident and the determination language in China is not uniform. The situation in other states is similar.[9]

Even if the method of mutual agreement can be effectively adopted, its shortage cannot be concealed despite its accuracy. The human factors of the resident status determination, such as the preference of authority in individual cases, will be significantly increased. If consensus cannot be achieved among sovereign states, the multinational corporate taxpayers may take advantage of the vagueness and thus avoid taxes. Therefore, it is critical to have common and sufficiently clear recognition criteria among states, which hopefully can be achieved through pre-negotiated multilateral treaties. By agreeing on the same clear criteria during the formation of multilateral treaties, efforts can be saved in individual cases.

The growth of FDI in the last few decades has greatly increased the volume of such tax issues, causing strain on the current framework for international taxation[10] due to the impossibility of negotiating over taxation for each individual transaction. In the meantime, attempts by individual countries to remedy these problems serve to simply shift them to other countries via spillover rather than actually solving them[11].

In common practice, nations also try to adopt a Limitation on Benefits Clause, including a Principal Purpose Test Clause (while the Limitation on Benefits Clause broadly includes the Principal Purpose Test Clause, these two can also be explicitly separate)[12], in order to effectively avoid Treaty Shopping and thus grant actual residents of states involved in the treaties of treaty benefits. The United States first adopted this approach after Aiken v. Commissioner of Internal Revenue (1971), in which the U.S. Federal Tax Court noted that, although the interest-earning party played an intermediary role between its parent company and the interest payer (the U.S. enterprise), the interest-earning party did not play a substantial commercial role in it, and therefore the Court held that the interest-earning party was not entitled to the relevant tax treaty benefits under the tax treaty between the United States and Honduras.[13] This tendency can be spotted in most tax treaties involving the United States. The core issue is whether the relevant arrangement of the tax subject has a substantial business purpose that satisfies any of the tests, such as the qualified resident, derivative interest, and head office corporation test under the 2016 U.S. model. In other words, a sufficiently strong nexus between the arrangement and the other contracting state must be proven.

The difficulty in applying these test provisions is that the clause standard does not directly and explicitly set a threshold condition. Generally, we understand that under the clause rule, after taking into account all the key facts and circumstances, it can be reasonably determined that the direct or indirect receipt of the benefit of the tax treaty is one of the main purposes of implementing the arrangement or transaction[14]. Although the BEPS MLI explains the ambiguity of application and gives more vivid and specific explanations by citing cases, there remain conflicts over the criteria in national practices.[15]

Suggestion

Recent multilateral initiatives are attempting to confront these problems. In the fourth quarter of 2021, 137 countries reached a ground-breaking agreement on the reform of international aspects of Corporate Income Tax (CIT) within the OECD-coordinated Inclusive Framework (IF) on BEPS (Base Erosion and Profit Shifting)[16]. The reform has two goals: (1) A mechanism for sharing a portion of the profits generated by the largest and most profitable “mega” multinational companies (MNEs), so that they contribute to the tax authorities of the countries where there is a critical mass of users of their services, even if the multinational does not have a permanent establishment there; and (2) A Global Minimum Tax on corporate entities so that the accounting profits of multinationals are subject to an effective minimum tax rate of 15%.[17]

Considering most cross-border tax treaties use language largely in line with the OECD Model Tax Convention, with about 80% of the wordings of the tax treaties being identical[18], nations shall be encouraged to enter into multilateral tax treaties instead of bilateral ones. This enables nations to negotiate beforehand and have mutually agreed upon criteria. Despite the difficulties in negotiating and bargaining over tax jurisdiction, it is time for worldwide states to figure it out with an open mind.

- The OECD Model Tax Convention on Income and on Capital, Dec. 18, 2017, 1 O.E.C.D. §3. ↑

- Reuven S. Avi-Yonah et al., Global Perspectives on Income Taxation Law 220 (2011). ↑

- Id. ↑

- OECD Model Tax, supra note 1. ↑

- Qian Nie (聂茜), Research on the legal issues of tax triangular in international tax treaties (国际税收协定中的“三角情形”法律问题研究), (2017). ↑

- Id. ↑

- In 1963, the OECD issued a draft model agreement to regulate competing tax jurisdictions based on the criteria of (1) permanent residence; (2) center of vital interests; and (3) habitual residence, based on agreements between the countries in which the tax jurisdictions are located (in the absence of an agreement, there is no exemption from taxation by either party). This rule is generally called Gabi Rule. Using Gabi Rules to Determine the Status of Individual Tax Residents in China, Kaizen CPA Limited (2019), https://www.bycpa.com/html/news/202010/2390.html. ↑

- Ying Tao (应涛), Ji Jinbiao (计金标), Tax Certainty, Multilateral Convention and Our Bilateral Tax Agreements, International Taxation (税收确定性、《多边公约》与我国双边税收协定) (2020). ↑

- See generally Committee on Fiscal Affairs, Improving the Resolution of Tax Treaty Disputes, Organization for Economic Cooperation and Development (2007). ↑

- Issues in International Taxation and the Role of the IMF, International Monetary Fund 4 (June 28, 2013), https://www.imf.org/external/np/pp/eng/2013/062813.pdf. ↑

- Id, at 7. ↑

- Yu Chen (陈宇), Haiying Guo (郭海英), Limitation of interest clauses and their application in China’s tax treaties (利益限制条款及其在我国税收协定中的应用), International Taxation (2021). ↑

- 56 T.C. R. 925 (1971). ↑

- Siling Wu (吴思灵), Research on the Application of the Main Purpose Test in International Tax Agreements (国际税收协定中主要目的测试的适用研究) (2019). ↑

- See generally Committee on Fiscal Affairs, supra note 9. ↑

- Advances in the new international taxation and challenges for Latin America and the Caribbean, Inter-American Center of Tax Administrations (June 8, 2022), https://www.ciat.org/ciatblog-avances-y-desafios-de-la-nueva-fiscalidad-internacional/?lang=en ↑

- Id. ↑

- Avi-Yonah, et al., supra note 2, at 220. ↑